Categories

- All Blogs (51)

- Buyer Stories (1)

- Buyer tips (7)

- Buyers (3)

- Buying (2)

- Buying Advice (3)

- Buying Assistance (3)

- Credit & Debt (2)

- Down Payment (1)

- Financing (8)

- Financing Options (1)

- First Time Home Buyer (20)

- Foreclosures (1)

- Interest Rates (2)

- Loans (4)

- Military (6)

- Mortgage Interest Rates (1)

- Mortgage Rates (1)

- New Construction (1)

- Personal Finance (2)

- Refinance (1)

- Schools (11)

- Tax tips (1)

- Title & Closing (1)

- VA Loans (1)

Recent Posts

Hickory High School Homes for Sale in Chesapeake, VA

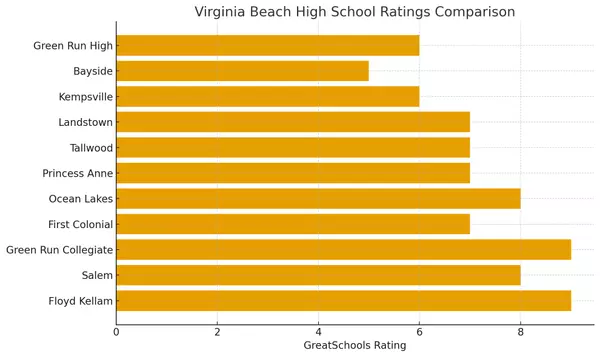

Virginia Beach High Schools Comparison Guide (2026 Update)

Green Run High School Homes for Sale in Virginia Beach, VA

Bayside High School Homes for Sale in Virginia Beach, VA

Kempsville High School Homes for Sale in Virginia Beach, VA

Landstown High School Homes for Sale in Virginia Beach, VA

Frank W. Cox High School Homes for Sale in Virginia Beach, VA

First Colonial High School Homes for Sale in Virginia Beach, VA

Tallwood High School Homes for Sale in Virginia Beach, VA

Princess Anne High School Homes for Sale in Virginia Beach, VA