FHA Loans: A Comprehensive Guide to Federal Housing Administration Loans

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). It comes with both advantages and disadvantages, which can help you decide if this loan type is right for you. FHA Loans: A Comprehensive Guide to Federal Housing Administration Loans FHA loans, backed by the Federal Hou

Read More

8 Steps to Boost Your Credit Score

There are many reasons you might want to improve your credit score. If you’re preparing to buy a home, a higher score can help you qualify for better mortgage rates. If you’re working your way back from financial challenges, boosting your credit is even more critical before applying for a home loan

Read More

Categories

- All Blogs (51)

- Buyer Stories (1)

- Buyer tips (7)

- Buyers (3)

- Buying (2)

- Buying Advice (3)

- Buying Assistance (3)

- Credit & Debt (2)

- Down Payment (1)

- Financing (8)

- Financing Options (1)

- First Time Home Buyer (20)

- Foreclosures (1)

- Interest Rates (2)

- Loans (4)

- Military (6)

- Mortgage Interest Rates (1)

- Mortgage Rates (1)

- New Construction (1)

- Personal Finance (2)

- Refinance (1)

- Schools (11)

- Tax tips (1)

- Title & Closing (1)

- VA Loans (1)

Recent Posts

Hickory High School Homes for Sale in Chesapeake, VA

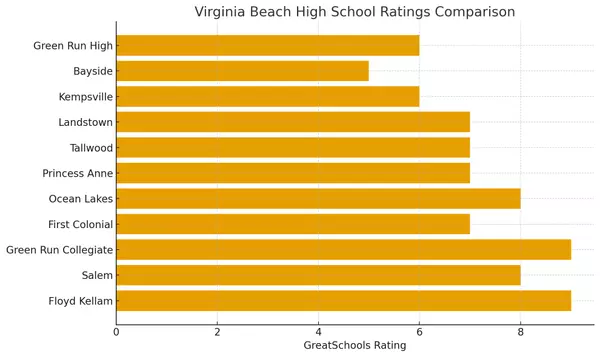

Virginia Beach High Schools Comparison Guide (2026 Update)

Green Run High School Homes for Sale in Virginia Beach, VA

Bayside High School Homes for Sale in Virginia Beach, VA

Kempsville High School Homes for Sale in Virginia Beach, VA

Landstown High School Homes for Sale in Virginia Beach, VA

Frank W. Cox High School Homes for Sale in Virginia Beach, VA

First Colonial High School Homes for Sale in Virginia Beach, VA

Tallwood High School Homes for Sale in Virginia Beach, VA

Princess Anne High School Homes for Sale in Virginia Beach, VA